1 Year Term Deposit Rates

| Provider | Rate | |||

|---|---|---|---|---|

|

ING Direct Australia 1 Year Term Deposit The Interest Rates for this 12 month / 1 year term product requires a minimum deposit of $10,000. |

2.75% 1 year | Mar 2019 | |

|

State Bank of India Australia 1 Year Term Deposit Minimum deposit of $250,000 required for residents to open the account. Minimum deposit of $20,000 for non-residents. |

2.05% 1 Year | Aug 2019 | |

|

Suncorp Bank 1 Year Term Deposit Interest Rate for this Suncorp deposit product depends on amount deposited and is for a 12 month / 1 year term. Interest is paid at maturity with minimum investment being $50,000. |

2.00% 1 year | Aug 2019 | |

|

1.95% 1 year | Aug 2019 | ||

|

1.80% 1 year | Aug 2019 | ||

|

AustralianSuper 1 Year Term Deposit The rate is applicable to the AustralianSuper member direct investment option product for its term deposit product. The applicable term in 365 days (% pa). You can invest in this option if you are an AustralianSuper member and have more than $10,000 in the account. (Note it may not be covered by the Government guarantee). Rate ranges from 3.67% to 3.90% |

1.78% to 2.00% 1 year | Aug 2019 | |

|

Bank of Sydney 1 Year Term Deposit Rate shown is applicable to deposits ranging from $250,000-$1,000,000 with interest calculated daily and paid at maturity. |

1.70% 1 year | Aug 2019 | |

|

Credit Union Australia 1 Year Term Deposit This CUA interest rate p.a indicated is for deposit balances of $5,000 or over and interest is calculated daily on the whole balance. It applies for a term of 12 months / 1 year and interest is paid on maturity. |

1.70% 1 year | Sep 2019 | |

|

Rural Bank 1 Year Term Deposit The interest rate applicable for this deposit is with 'interest paid annually' and is for balances between $5000 and $500000 |

1.60% 1 year | Sep 2019 | |

|

1.50% 1 year | Sep 2019 |

A 1 year deposit or commonly also known as a 360 day or 12 month deposit is one of the most popular types of deposit products in Australia along with the six month deposit. It is a medium term maturity product.

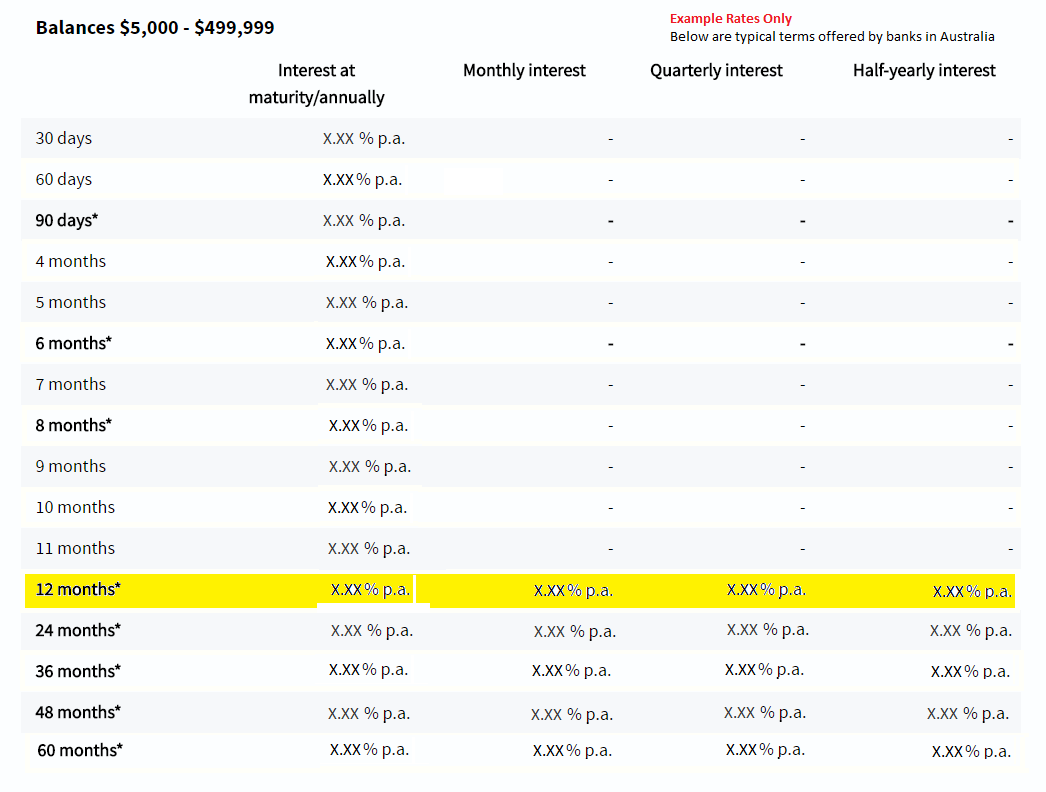

Interest accumulated through a 1 year deposits is paid monthly, quarterly, annualy or semi-annually as per the following example from a local Australian bank.

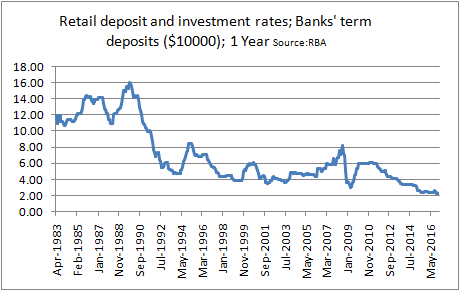

Data sourced from the RBA from banks in Australia indicates that 1yr rates peaked at around 16% in the late 80s but have fallen significantly over the last 2 decades.